Accumulation of Financial Assets Increasingly Unequal, Especially for Blacks and Hispanics

Growing Economic Inequality and Changes to Retirement Structure Further Weaken Middle Class Retirement Security

The National Institute on Retirement Security Hosts a Webinar to Review New Research Report

WASHINGTON, D.C., September 1, 2021 – A new report finds that economic inequality continues to grow, with Blacks and Hispanics owning only a sliver of financial assets. Even though the Gen X and Millennial generations are more diverse, whites continue to dominate when it comes to accumulating financial assets. This economic inequality ultimately translates into financial insecurity in retirement, which is exacerbated by the shift from pensions to individual 401(k) savings accounts.

Stark Inequality: Financial Asset Inequality Undermines Retirement Security, released today by the National Institute on Retirement Security (NIRS) is available here. Register here for a webinar on Wednesday, September 8, 2021, at 2:00 PM ET with a review of the research.

The data in this report reveal that among Baby Boomers, Generation X, and Millennials, Black and Hispanic Americans own small percentages of financial assets.

- White Baby Boomers owned more than 90 percent of that generation’s financial assets, while Black or Hispanic Boomers owned three percent or less for the periods studied.

- White Gen Xers owned roughly four-fifths of that generation’s financial assets in each of the four survey years included in the research.

- Despite being a more racially diverse cohort, white Millennials owned three-fourths of this generation’s financial assets in 2019.

“A retirement system built around the individual ownership of financial assets cannot provide retirement security for many if the ownership of financial assets is concentrated among the few,” says Tyler Bond, report author and research manager for NIRS.

“A retirement system built around the individual ownership of financial assets cannot provide retirement security for many if the ownership of financial assets is concentrated among the few,” says Tyler Bond, report author and research manager for NIRS.

“This stark inequality is even more problematic because the U.S. has largely shifted to a retirement system built around the individual ownership of financial assets in 401(k) or IRA accounts rather than pensions. Few financial assets during one’s working years translates into retirement insecurity later in life,” Bond explained.

He added, “The data also show an alarming reality for Blacks and Hispanics. Not only do they hold a small share of financial assets across generations, that share is falling in some cases. Absent serious policy changes, Blacks and Hispanics are not positioned to improve their economic and retirement outlook.”

This report’s key findings are as follows:

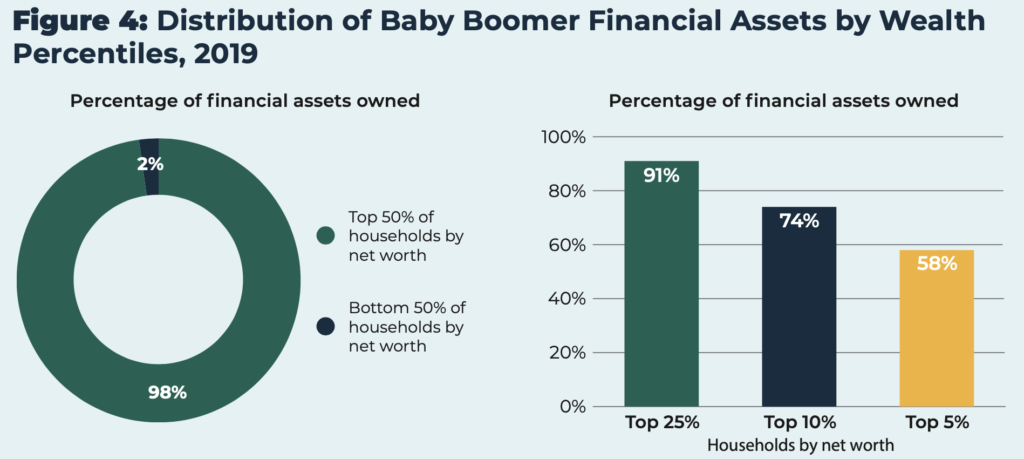

- Inequality in the ownership of financial assets both persists and deepens over time. The top five percent of Baby Boomers by net worth owned a greater percentage of that generation’s financial assets in 2019 (58 percent) than in 2004 (52 percent).

- Inequality in the ownership of financial assets is consistent across generations. In 2019, the top 25 percent by net worth of Millennials, Generation X, and Baby Boomers owned three-quarters or more of their generation’s financial assets.

- Financial asset ownership is highly concentrated among white households. In 2019, white households in all three generations owned three-quarters or more of their generation’s financial assets. Ownership is especially concentrated among white households in the top 25 percent of net worth.

- Both mean and median financial assets were significantly higher for white households in 2019 than Black or Hispanic households.

- A range of potential solutions exists to address this stark inequality including strengthening and expanding Social Security, protecting pensions, increasing access to savings-based plans for low-income workers, and reforming retirement tax incentives.

This research is based upon data from the Federal Reserve’s Survey of Consumer Finances (SCF). It examines financial asset ownership by net worth, generation, and race, and considers three generational cohorts: Millennials, Generation X, and Baby Boomers. Millennials are assessed in 2016 and 2019, while Generation X and Baby Boomers are assessed in 2004, 2010, 2016, and 2019.

The research examines financial assets, a broader category than retirement assets. According to the SCF, the category of financial assets consists of liquid assets, certificates of deposit, directly held pooled investment funds, stocks, bonds, quasi-liquid assets, savings bonds, whole life insurance, other managed assets, and other financial assets. It does not include physical assets such as a home or a car. The data for this research is for households rather than individuals.

The National Institute on Retirement Security is a non-profit, non-partisan organization established to contribute to informed policymaking by fostering a deep understanding of the value of retirement security to employees, employers and the economy as a whole. Located in Washington, D.C., NIRS membership includes financial services firms, employee benefit plans, trade associations, and other retirement service providers. More information is available at www.nirsonline.org. Follow NIRS on Twitter @NIRSonline.