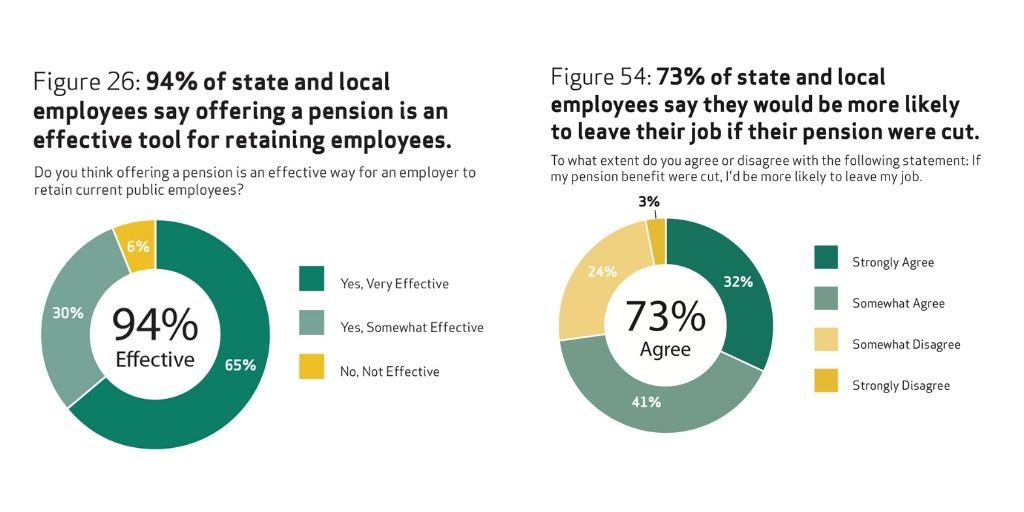

At a time when state and local governments are struggling to attract and retain employees to deliver vital taxpayer services, a new national poll finds that retirement and healthcare benefits are critically important job features, more so than salary. These benefits are viewed as a powerful recruitment and retention tool, with nearly all state and local workers (93 percent) saying that pensions incentivize public workers to have long public service careers, and 94 percent agreeing that a pension is a good tool for both attracting and retaining employees.

These findings are contained in new research, State and Local Employee Views on Their Jobs, Pay and Benefits. The findings are published by the National Institute on Retirement and based on research conducted by Greenwald & Associates. NIRS also has published three professions fact sheets that provide a deeper dive on the views of teachers, firefighters and law enforcement professionals.

The findings will be reviewed during a webinar on Monday, November 18 2019, at 2:00 PM ET. Register at no charge here.

The research also finds that cutting benefits could have severe workforce consequences. Some 73 percent say they would be more likely to leave their job if their pension were cut, and 79 percent say they would be more likely to leave their job if their healthcare benefits were cut. Also, nearly all (92 percent) state and local employees say eliminating pensions for the public workforce will weaken governments’ ability to attract and retain qualified workers, while the vast majority say eliminating pensions would weaken public safety and the U.S. education system.

The research also finds that cutting benefits could have severe workforce consequences. Some 73 percent say they would be more likely to leave their job if their pension were cut, and 79 percent say they would be more likely to leave their job if their healthcare benefits were cut. Also, nearly all (92 percent) state and local employees say eliminating pensions for the public workforce will weaken governments’ ability to attract and retain qualified workers, while the vast majority say eliminating pensions would weaken public safety and the U.S. education system.

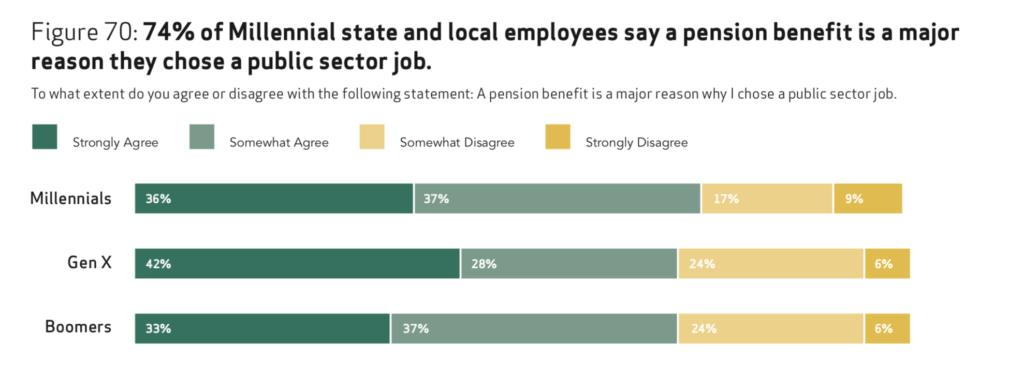

And in contrast to conventional wisdom that Millennials are “dissatisfied job hoppers,” the research finds that 84 percent of Millennials working in state and local government are satisfied with their current job. Nearly three-fourths (74 percent) say a pension benefit is a major reason they chose a public sector job, while 85 percent say they plan to stay with their current employer until they are eligible for retirement or can no longer work.

The key research findings are as follows:

- State and local employees place a high value on serving the public and their community, and are generally satisfied with their job despite high stress. The vast majority (89 percent) of state and local employees are satisfied with the ability to serve the public aspect of their job. Some 85 percent are satisfied with their jobs, while 71 percent say their jobs are stressful.

- Benefits are among the most important job features for state and local employees. Health insurance is very important to 78 percent of state and local employees, and retirement benefits are very important to 73 percent. Salary is less important, at 71 percent.

- State and local employees have mixed views on the competitiveness of their salary and compensation, but the vast majority agree they could earn a higher salary in the private sector and a pension factors into the competitiveness of their compensation. Only 22 percent of state and local employees say their salaries are very competitive, and 80 percent say they could earn a higher salary in the private sector.

- Benefits are viewed as a powerful recruitment and retention tool across state and local government professions. Nearly all state and local workers (93 percent) say pensions incentivize public workers to have long public service careers, while 94 percent say offering a pension is a good tool for attracting and retaining employees. The vast majority of state and local employees (89 percent) say they plan to stay with their current employer until they are eligible for retirement or can no longer work.

- State and local government employees overwhelmingly have favorable views of pensions, with lasting retirement income and monthly checks the most important features. Some 94 percent of state and local employees have favorable views of defined benefit pensions.

- Most public workers feel they will be financially secure in retirement, but the vast majority of state and local employees are highly concerned about cuts to retirement benefits & government officials underfunding of pension plans. Nearly three-fourths (72 percent) of state and local employees are confident they will be financially secure in retirement. But, 86 percent are concerned about cuts to their retirement benefits while 85 percent are concerned about government officials underfunding their pension.

- Cutting state and local employee benefits could drive them out of the public workforce. More than half of state and local employees (58 percent) say that switching them out of a pension into an individual retirement plan, like a 401(k)-style plan, would make them more likely to leave their job. Some 73 percent say they would be more likely to leave their job if their pension were cut, and 79 percent say they would be more likely to leave their job if their healthcare benefits were cut.

- State and local employees say eliminating pensions has risks. Nearly all (92 percent) state and local employees say eliminating pensions for the public workforce will weaken governments’ ability to attract and retain qualified workers to deliver public services. The vast majority (83 percent) say eliminating pensions would weaken public safety. Similarly, 87 percent say eliminating pensions would weaken the U.S. education system.

- Millennials working in state and local government generally share the views of Baby Boomers and GenXers on their job, serving the public, pay, and benefits. Some 84 percent of Millennials working in state and local government are satisfied with their current job, while 90 percent say they are committed to serving the public. Most (80 percent) Millennial state and local employees say they could earn a higher salary in the private sector. Nearly three-fourths (74 percent) of Millennial state and local employees say a pension benefit is a major reason they chose a public sector job, while 85 percent say they plan to stay with their current employer until they are eligible for retirement or can no longer work.