Across Generations, U.S. Middle Class Households Have Few Financial Assets, According to New Analysis from the National Institute on Retirement Security

Lack of Assets Will Mean Retirement Insecurity for Middle Class Families

WASHINGTON, D.C., October 14, 2021 – A new analysis finds that across generations, middle class households in the U.S. own few financial assets and the median amounts held fall far short of the assets needed to fund a secure retirement. In 2019, middle class Millennials owned only 14 percent of their generation’s financial assets. The numbers are even worse for middle class Gen Xers and Baby Boomers, which owned eight percent and six percent, respectively, of their generation’s financial assets.

These findings are contained in a new research infographic from the National Institute on Retirement Security (NIRS). Read the research here. This infographic supplements a recent NIRS report, Stark Inequality: Financial Asset Inequality Undermines Retirement Security, available here.

“In America, the middle class can no longer afford retirement. Middle class Americans face sharp economic inequality, with ownership of financial assets highly concentrated among the wealthy,” explained Tyler Bond, NIRS research manager. “Now that we have a retirement system largely built around the individual ownership of financial assets in 401(k) accounts, middle class Americans are struggling to accumulate sufficient financial assets during their working years. This means the retirement outlook for many in the middle class is bleak at best.”

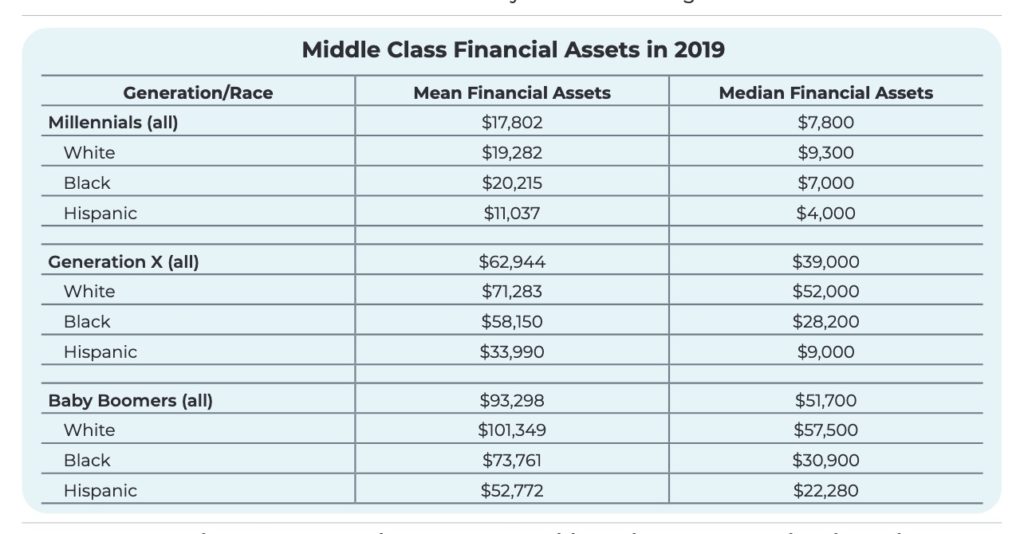

The research also finds low numbers when examining the mean and median financial assets owned.

- For middle class Millennial households in 2019, the mean financial assets owned were $17,802, and the median was $7,800.

- Middle class Generation X households had mean financial assets of $62,944, and median financial assets of $39,000 in 2019.

- For middle class Baby Boomers, the mean amount of financials assets held was $93,298 in 2019, while the median was only $51,700.

“Baby Boomer households are retired or near retirement, but their assets fall far short of what’s required to finance a secure retirement,” Bond explained. “A nest egg of $51,700, the median amount middle class Boomers hold, would generate only $2000 of income annually over 30 years. This means that many middle class Boomer households may struggle in retirement and could face a sharp reduction in their standard of living.”

“Baby Boomer households are retired or near retirement, but their assets fall far short of what’s required to finance a secure retirement,” Bond explained. “A nest egg of $51,700, the median amount middle class Boomers hold, would generate only $2000 of income annually over 30 years. This means that many middle class Boomer households may struggle in retirement and could face a sharp reduction in their standard of living.”

The research indicates that implementing pragmatic policy solutions can help middle class households get on a better path to saving for retirement including strengthening and expanding Social Security; protecting defined benefit pensions; and ensuring access to a retirement savings plan through an employer.

For this research, the middle class is defined as those between the 30th and 70th percentiles of net worth, or the middle 40 percent. As in the Stark Inequality report, three generational cohorts are considered in this middle class analysis: Millennials, Generation X, and Baby Boomers.

The research is based upon data from the Federal Reserve’s Survey of Consumer Finances (SCF). It examines financial asset ownership, a broader category than retirement assets. According to the SCF, the category of financial assets consists of liquid assets, certificates of deposit, directly held pooled investment funds, stocks, bonds, quasi-liquid assets, savings bonds, whole life insurance, other managed assets, and other financial assets. It does not include physical assets such as a home or a car. The data for this research is for households rather than individuals.

The National Institute on Retirement Security is a non-profit, non-partisan organization established to contribute to informed policymaking by fostering a deep understanding of the value of retirement security to employees, employers, and the economy as a whole. Located in Washington, D.C., NIRS membership includes financial services firms, employee benefit plans, trade associations, and other retirement service providers. More information is available at www.nirsonline.org. Follow NIRS on Twitter @NIRSonline.

##