A new research report finds that across party lines, Americans are deeply worried about their economic security in retirement.

Retirement Security 2017: Americans’ Views of the Retirement Crisis finds that America faces a deep political divide, but not when it comes to economic security in retirement. This research reports that 76 percent of Americans are concerned about their ability to achieve a secure retirement, with that level of worry at 78 percent for Democrats and 76 percent for Republicans. Some 88 percent of Americans agree that the nation faces a retirement crisis, and the concern is high across party lines.

The key research findings are as follows:

- Across party lines, Americans are worried about economic insecurity in retirement. Three-fourths (76 percent) of Americans are concerned about economic conditions affecting their ability to achieve a secure retirement. For respondents that identified themselves as Democrats, the level of concern was at 78 percent compared to 76 percent for Republicans.

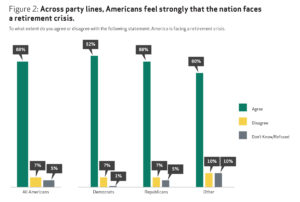

- Americans in overwhelming numbers continue to believe the nation faces a retirement crisis. Some 88 percent of Americans agree that the nation faces a retirement crisis. The level of concern is high across gender, income, age and party affiliation. Importantly, more than half (55 percent) strongly agree that there is a crisis. To ensure a secure retirement, three-fourths of Americans plan to work longer and to spend less in retirement.

- Americans regard pensions as a route to economic security in retirement, and see these retirement plans as better than 401(k) accounts. We find that some 82 percent of Americans have a favorable view of pensions. A full 85 percent say all workers should have access to a pension plan so they can be independent and self-reliant in retirement. More than three-fourths of Americans (77 percent) say the disappearance of pensions has made it harder to achieve the American Dream. Some 71 percent of Americans say that pensions do more to help workers achieve a secure retirement as compared to 401(k) plans, and 65 percent say pensions are safer than 401(k) plans.

- Americans say national leaders still don’t understand their retirement struggle, and they remain highly supportive of state efforts to address the retirement crisis. An overwhelming majority of Americans (85 percent) say leaders in Washington do not understand how hard it is to prepare for retirement, which held steady from 87 percent in 2015. Similarly, 86 percent say leaders in Washington need to give a higher priority to ensuring that Americans have a secure retirement. In terms of solutions, 82 percent of Americans say government should make it easier for employers to offer pensions.

- Protecting Social Security remains important to Americans. Some 76 percent of Americans say it is a mistake to cut government spending to reduce Social Security benefits for current retirees, up from 73 percent in 2015. When it comes to adjusting benefits for future generations, 73 percent oppose cutting government spending that reduces Social Security benefits.

- Americans strongly support pensions for public sector workers and see these retirement plans as a strong recruitment and retention tool. Americans strongly support pensions for police officers and firefighters (90 percent), and teachers (81 percent). Some 81 percent say these benefits are deserved because public employees help finance the cost from every paycheck, up from 77 percent in 2015.

The survey was conducted as a nationwide telephone interview of 800 Americans age 25 or older in to assess their sentiment regarding retirement and actions policymakers could take to strength retirement. Greenwald & Associates balanced the data to reflect the demographics of the United States for age, gender and income. The margin of error is plus or minus 3.5 percent. Sums of two or more figures may not equal the expected total due to rounding.